Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

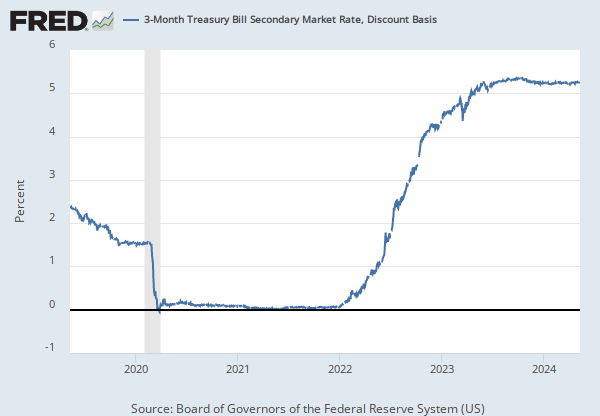

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Averages of Business Days, Discount Basis

Suggested Citation:

Board of Governors of the Federal Reserve System (US), 3-Month Treasury Bill Secondary Market Rate, Discount Basis [TB3MS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TB3MS, May 12, 2024.

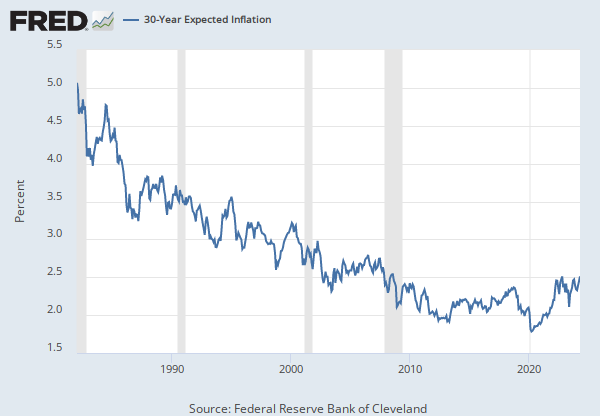

Source: Federal Reserve Bank of Cleveland

Release: Inflation Expectations

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

The Federal Reserve Bank of Cleveland estimates the expected rate of inflation over the next 30 years along with the inflation risk premium, the real risk premium, and the real interest rate.

Their estimates are calculated with a model that uses Treasury yields, inflation data, inflation swaps, and survey-based measures of inflation expectations.

For more information, please visit the Federal Reserve Bank of Cleveland.

Suggested Citation:

Federal Reserve Bank of Cleveland, 2-Year Expected Inflation [EXPINF2YR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EXPINF2YR, May 12, 2024.

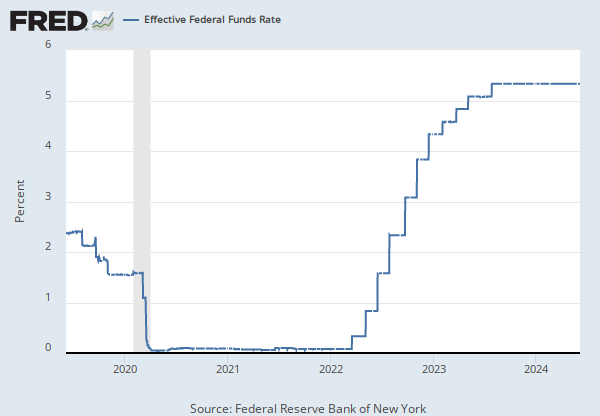

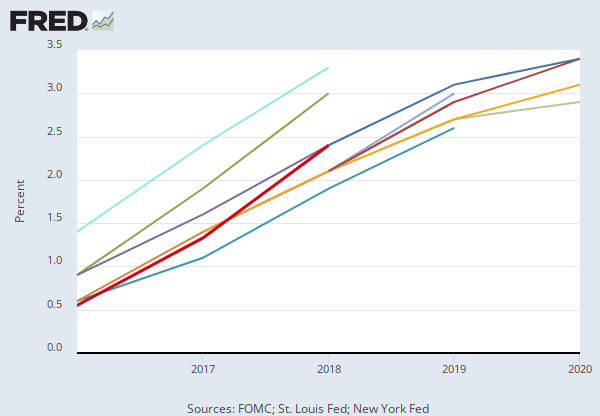

Source: U.S. Federal Open Market Committee

Source: Federal Reserve Bank of St. Louis

Release: Summary of Economic Projections

Units: Percent, Not Seasonally Adjusted

Frequency: Annual

Notes:

The projections for the federal funds rate are the value of the midpoint of the projected appropriate target range for the federal funds rate or the projected appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run. Each participant's projections are based on his or her assessment of appropriate monetary policy. The range for each variable in a given year includes all participants' projections, from lowest to highest, for that variable in the given year. This series represents the median value of the range forecast established by the Federal Open Market Committee. For each period, the median is the middle projection when the projections are arranged from lowest to highest. When the number of projections is even, the median is the average of the two middle projections.

Digitized originals of this release can be found at https://fraser.stlouisfed.org/publication/?pid=677.

Suggested Citation:

U.S. Federal Open Market Committee and Federal Reserve Bank of St. Louis, FOMC Summary of Economic Projections for the Fed Funds Rate, Median [FEDTARMD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDTARMD, May 12, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.10 Foreign Exchange Rates

Units: Japanese Yen to One U.S. Dollar, Not Seasonally Adjusted

Frequency: Daily

Notes:

Noon buying rates in New York City for cable transfers payable in foreign currencies.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Japanese Yen to U.S. Dollar Spot Exchange Rate [DEXJPUS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DEXJPUS, May 12, 2024.

RELEASE TABLES

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

3-Month Treasury Bill Secondary Market Rate, Discount Basis

Annual, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedJapanese Yen to U.S. Dollar Spot Exchange Rate

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted